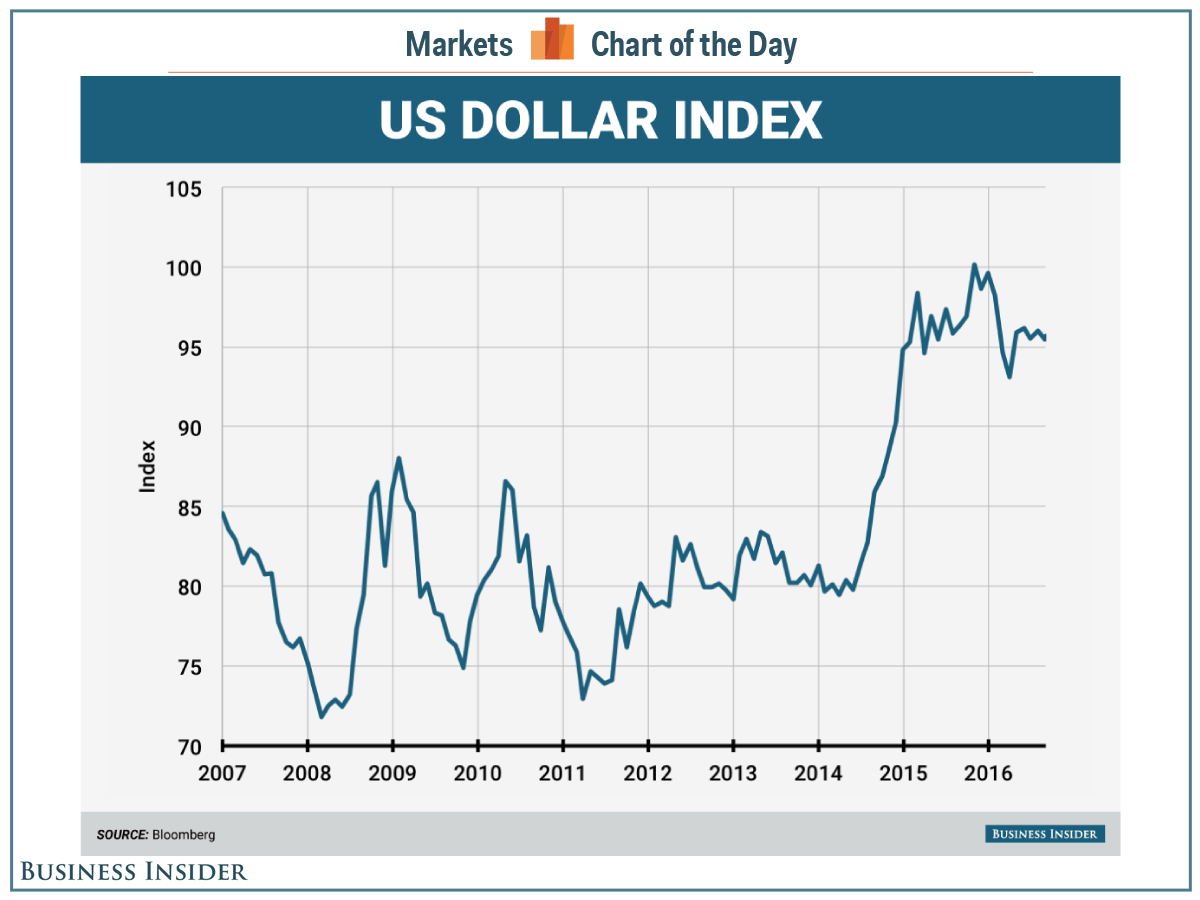

One of the big-picture economic trends over the past two years has been the stronger US dollar.

Back in May, analysts had even been arguing that the greenback had some more room to go this year and next in light of the better-performing US economy and what at the time seemed to be a more active Federal Reserve.

In the past few months, however, the US dollar index has remained more or less flat, hovering near a range of 93 to 98.

And now, Jefferies’ chief market strategist, David Zervos, is arguing that this year’s presidential election could actually lead to a weaker American currency. That is in part because of the two major-party nominees’ positions on free trade, with Republican Donald Trump being the more negative influence.

“If the US moves away from free trade agreements, as Trump has suggested, returns on capital will fall,” Zervos said in a note to clients. “Domestic labor may gain but the gains shouldn’t exceed the losses for capital income, and if the losses to capital income are large enough, even labor may lose. Lower returns on capital should lower real rates and lower the dollar, just as we saw with the GBP following the Brexit vote.”

"I believe that a Clinton win would also usher in a minor pivot toward higher trade barriers so that she too would be USD bearish, but less so," he added.

The US dollar index was up by 0.24% at 95.69 as of 3:27 p.m. ET on Monday.